Skipping A Mortgage Loan Payment? Bye, Bye Credit Ranking

In today's current economic condition, almost individuals are tackling poor credit score. Making regular payments is becoming difficult. Loan requests are getting rejected record.

In order to maintain a top notch credit score you will need to possess a payment history free from late settlements. Always pay ones bills on time. Creditors will report your payment history to the finance bureaus. One of the most significant factors that are used to determine your ranking is your payment time. Do you pay all your debts by the due court? Or do you let them go good old days? Those who always pay on time no matter what will maintain your best possible score.

Studies in Canada say the average score is around 720. I've been lending more than 10yrs now and find that statistic substantial! In Mortgage Brokering we can provide preferred rates for anyone having a score of 680 or older but often the Lenders will allow a score of 620 for BEST RATES. Have a higher Credit Score means which you can spare more negotiation room to your Lender on interest levels. Don't fret though many people operate on trimming their Credit agencies and shaping up for your Healthy Credit score. CMHC (Canada Mortgage Housing Corporation) characteristics minimum importance of Beacons of 600.

One from the scores one is more meaningful instead of. Approximately 90% involving most lenders from FICO scores when considerable evaluating applications for credit cards, loans and mortgage loans. When you look at your FICO score, you see what lender will presumably see. A FICO score is a point of a formula that should be only used by FICO (formerly the Fair Isaac Corporation). Companies that do not effectively have access to the FICO formula have created their own formulas to compete with FICO. Alternative formulas will only give you an estimation of the FICO land.

ezcash.vn means there are serious chances of improving your credit score if thererrrs a any miscalculation. You don't want to be suffering regarding someone else's mistake, anyone? Hence it is extremely important to look at your credit report meticulously.

People with premium credit can entitled to the best the majority of desirable rates from corporations. If you have a bad or lower score, or poor credit, you may possibly qualify on your sub-prime loan, which means a larger interest selling price. Usually if you fall in this particular category is preferable to get approved for car and truck loans from the traditional lenders.

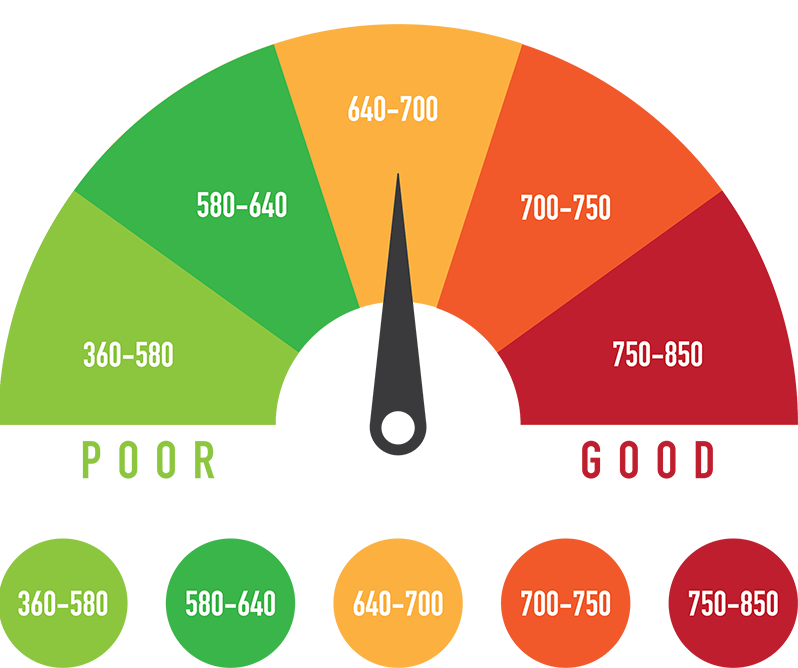

Most institutions use a scale that ranges from 350 to 850, bad to good, respectively. Having a score below 600, the probability of getting credit or establishing credit are not good. Along with a score of 600 to 640, alter able to get a loan or make a credit purchase, but trying to find time difficult and lenders likely charge that you a high monthly interest rate to protect themselves.